Foreign Trade Zone

Welcome to Volusia County’s Foreign Trade Zone (FTZ) No. 198

FTZ No. 198 is an essential part of the County’s local and international investment strategy providing a business solution to accelerate domestic and foreign trade in the region.

Administered through the Volusia County Economic Opportunity office, the Grantee and General Purpose (GP) Operator, FTZ No. 198 is continuously improving services through best practices and strategic alliances.

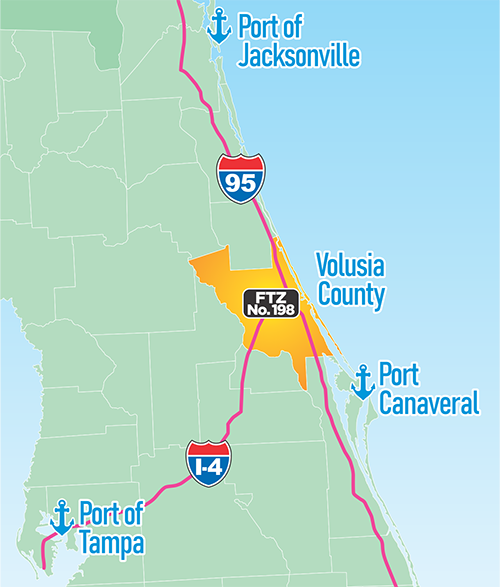

Logistically Located

Located in Volusia County, Florida, at the interchange for Interstate 95 and Interstate 4, FTZ No 198 is within easy driving distance of two deep-water ports, two rail lines and 10+ international airports.

Easy Integration

FTZ No. 198's Alternative Site Framework (ASF) allows for easy integration into the FTZ program using your company's existing facility or any other industrial site / location within Volusia County.

Benefits

Defer and Reduce Taxes

- Reduce duties on goods processed or assembled in the FTZ when imported components have a higher duty rate than the finished goods (tariff inversion).

- Defer customs duties and taxes until merchandise is transferred from the FTZ to domestic market.

- Eliminate duties entirely on scrap, damages, zone transfers and goods reshipped outside the U.S.

- Reduce merchandise processing / entry fees substantially with just one entry filed each week and one fee (with maximum cap) per entry.

- Defer harbor maintenance fee payments through quarterly remittance payments

Streamline Customs Clearance

Inbound import freight shipments that are delivered to an FTZ facility benefit from a streamlined clearance processing system by U.S. Customs at the arriving port.

Operate More Efficiently

Efficiently manage cash flow and save a significant amount of money on imported cargo shipments used in manufacturing or distribution operations by using FTZ No. 198.

Fast Approvals

Storage and distribution sites will have the ability to be approved in 30 days or less; manufacturing and processing facilities could be approved within 120 days or less.

Connect

Our FTZ Administrator is ready to answer your questions.

For more information, contact:

Volusia County Division of Economic Development

Katrina Friel, Business Manager

386-248-8048